Where to Find Dependable hard money lenders in Atlanta Georgia

Where to Find Dependable hard money lenders in Atlanta Georgia

Blog Article

Why a Hard Cash Lending Could Be the Right Option for Your Next Investment

In the realm of real estate financial investment, the quick pace and high risks frequently necessitate non-traditional financing solutions. Enter tough cash financings, a device that focuses on swift authorization and financing, as well as the residential property's value over a consumer's credit report. In spite of their possible high costs, these car loans can be the secret to opening your next rewarding deal. What makes them a feasible alternative, and when should they be taken into consideration? Let's unfold the tale.

Comprehending the Essentials of Tough Money Fundings

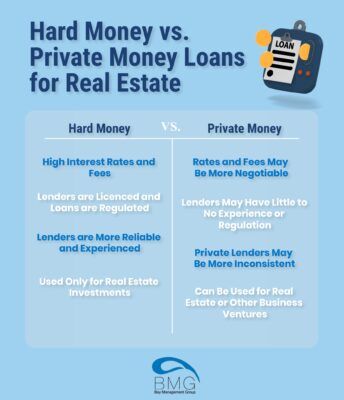

While typical finances might be familiar to most, comprehending the essentials of hard cash finances is critical for possible investors. Hard cash loans are a kind of short-term funding where the investor secures the Finance with property residential or commercial property as security. Unlike standard lendings, the approval and financing times are much faster, often within a week. The Funding quantity is largely based upon the home's worth instead than the consumer's creditworthiness. Usually, these finances have greater interest prices and are planned for investment possibilities that need quick financing. Lenders are generally exclusive business or individuals, making the Loan terms and prices more flexible than traditional small business loan. Comprehending these key attributes is the initial step in using difficult cash finances successfully.

The Advantages of Choosing Difficult Cash Fundings

Possible Disadvantages of Difficult Money Financings

Regardless of the benefits, there are additionally prospective drawbacks to consider when dealing with tough money lendings. The most remarkable is the high rate of interest. Because tough money lending institutions handle even more risk with these finances, they typically call for higher returns. This can indicate rate of interest that are a lot more than those of typical fundings (hard money lenders in atlanta georgia). An additional drawback is the brief Loan term. Difficult cash finances are generally short-term financings, normally around 12 months. This can place pressure on the debtor to repay the Finance rapidly. These fundings additionally have high costs and shutting costs. Debtors might have to pay a number of factors in advance, which can include substantially to the total cost of the Finance. These factors can make difficult cash car loans much less attractive for some financiers.

Real-Life Circumstances: When Tough Money Finances Make Good Sense

Where might hard cash lendings be the excellent monetary solution? Genuine estate investors looking to take a time-sensitive opportunity might not have the luxury to wait for standard financial institution fundings.

Right here, the difficult cash Loan can finance the restoration, boosting the building's helpful resources value. Thus, in real-life situations where rate and flexibility are essential, hard money fundings can be the excellent service (hard money lenders in atlanta georgia).

Tips for Browsing Your First Hard Money Financing

Exactly how does one efficiently navigate their very first difficult money Financing? Guarantee the investment building has prospective earnings adequate to cover the Lending and create revenue. Difficult cash fundings are short-term, normally 12 months.

Conclusion

Finally, tough cash lendings provide a quick, flexible funding alternative for real estate financiers aiming to take advantage of on time-sensitive possibilities. Despite potential drawbacks like higher rate of interest, their ease of gain access to and emphasis on property value over creditworthiness make them an appealing selection. With mindful factor to consider and audio financial Full Report investment methods, difficult cash financings can be a powerful tool for taking full advantage of returns on temporary tasks.

While typical loans may be familiar to most, understanding the essentials of tough money car loans is essential for potential capitalists. Difficult money loans are a kind of short-term funding where the capitalist safeguards the Finance with genuine estate residential or commercial property as collateral. Lenders are generally personal business or people, making the Finance terms and rates even more versatile than typical bank lendings. Unlike typical bank loans, tough money lending institutions are mainly worried with the value of the see this site building and its prospective return on financial investment, making the approval procedure less rigid. Hard cash lendings are commonly short-term financings, typically around 12 months.

Report this page